Market Overview

The payments landscape is undergoing rapid transformation, driven by a surge in digital transactions and an increased emphasis on payments modernization. As banks and financial institutions continue to evolve their digital strategies, safeguarding these advancements against emerging fraud threats has become a critical priority.

The ACI Worldwide 2024 Scamscope report reveals that global losses from Authorised Push Payment (APP) scams, a trust-based manipulation, will likely hit $7.6 billion by 2028. One in four scam victims will leave their current financial institution, and around 20% will close their accounts without opening new ones, underscoring the critical need to protect customers and maintain trust. APP fraud increasingly exploits emotional vulnerabilities, eroding the trust between consumers and banks.

To navigate this rapidly evolving environment, financial institutions must act quickly to protect customers and restore confidence. With predictions of significant increases in APP fraud values, banks need to adopt more effective prevention strategies. It is imperative that they invest in comprehensive fraud management solutions that leverage innovative technologies like Artificial Intelligence (AI) and Machine Learning (ML). These solutions are essential to empower organizations to detect and respond to fraudulent activities with greater speed and accuracy, reinforcing trust and resilience within the financial ecosystem.

A coordinated approach emphasizing collective intelligence is essential to improving real-time fraud detection.

About the Roadshow

Join ACI Worldwide’s upcoming Payments Intelligence Roadshow – Mumbai Edition, to get expert insights from industry leaders, and explore how combining AI, ML, network intelligence, and next-gen payment hubs can reduce risk in real time.

Compete, grow, and thrive in the digital-first world with the company that has been powering the world’s payments ecosystem for 50 years. Put our expertise to work for you.

MUMBAI EVENT SPEAKERS

Ankur Saxena

Senior Director – South Asia, UAE & Oman

ACI Worldwide

Damon Madden

Regional Solution Consultant & Fraud Expert – MEASA

ACI Worldwide

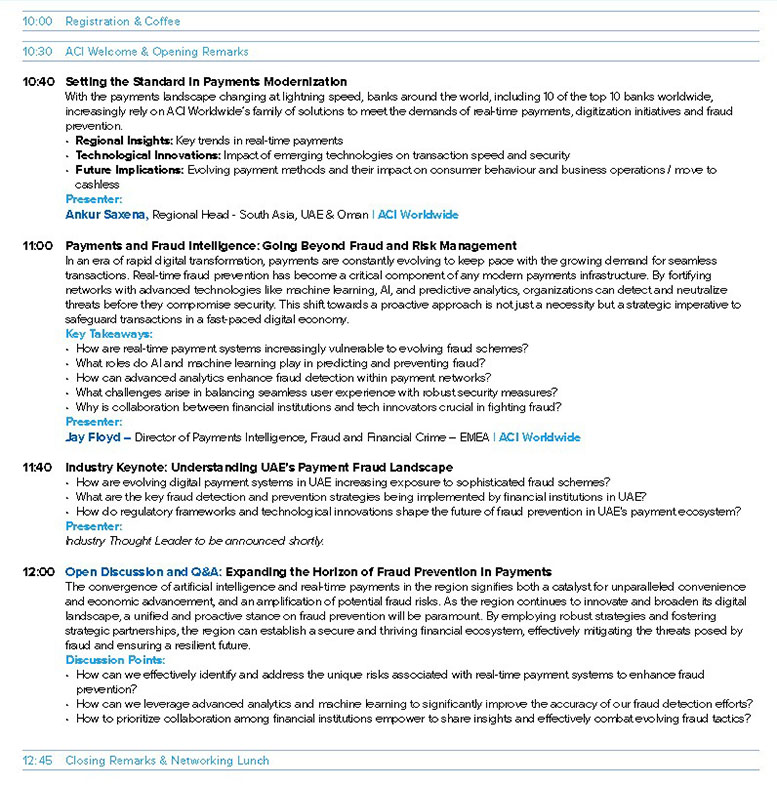

AGENDA Timings are subject to change*

04:00 PM | Registration and tea

04:30 PM | ACI welcome and opening remarks

04:45 PM | Payments intelligence: Going beyond fraud and risk management

05:30 PM | Industry Keynote: Understanding India’s payments fraud landscape

06:00 PM | Moderated discussion and Q&A: Expanding the horizon of fraud prevention in payments

06:30 – 08.00 PM | Closing remarks and networking drinks